Global monetary policy, geopolitics and demand dynamics – three driving forces that are favorable to gold

- January 7, 2025

- Posted by: Macro Global Markets

- Category: News

2024 is undoubtedly a spectacular year for the gold market. Heightened geopolitical tensions, growing demand for gold from Asian consumers, and strong central bank purchases of the precious metal pushed gold prices to 41 new closing records in the first ten months, reaching an all-time high of $2,790 per ounce at the end of October. Although gold’s momentum stalled at the end of last year as Trump won the US election, driving up risk assets and the dollar, State Street believes that gold prices still have room to rise in 2025. The bank expects gold prices to fluctuate between $2,600 and $2,900 per ounce in 2025, with the potential to even rise to $3,100 per ounce.

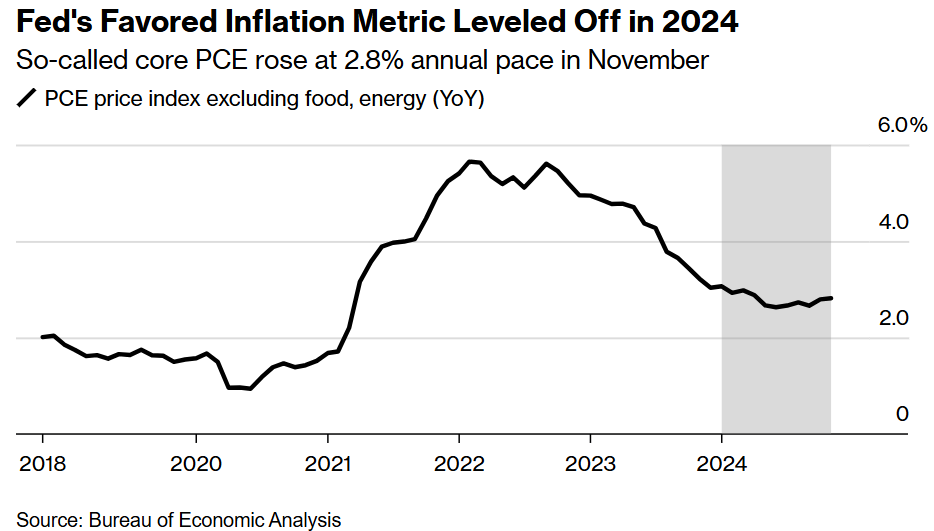

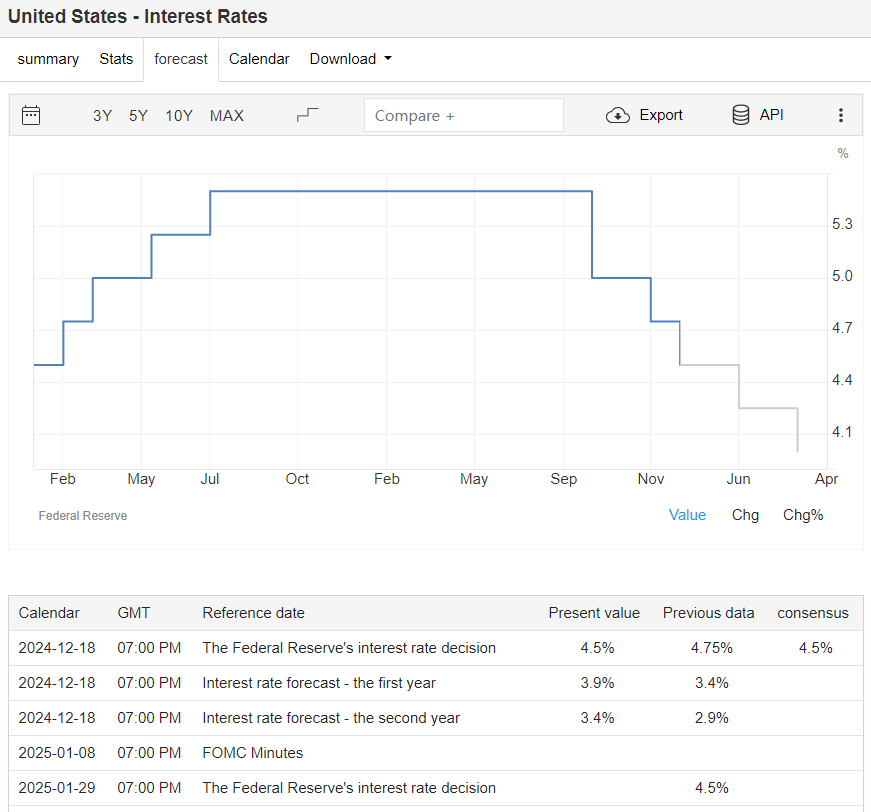

For many analysts, the Federal Reserve’s monetary policy remains the dominant force in global financial markets, as the Fed struggles to find a balance between continued inflationary pressures and supporting economic activity. In the final weeks of 2024, the Fed’s monetary policy expectations changed dramatically. At its last monetary policy meeting on December 19, the Fed hinted that it would cut interest rates only twice next year; in its updated economic forecasts in September, the Fed had expected four rate cuts. Analysts pointed out that the Fed’s policy shift is reasonable because the economy is expected to remain relatively healthy at least in the first half of the new year. Most major investment banks have lowered their expectations for interest rates. Fixed income analysts at Bank of America are in line with the Fed’s expectations, expecting only two rate cuts next year. Wells Fargo is slightly hawkish, expecting only one rate cut in 2025.

BlackRock, the world’s largest fund management company, is betting on the uniqueness of the United States and continues to increase its investment in U.S. stocks. BlackRock analysts pointed out that the U.S. economy is still in the best position to benefit from the “superpowers” in the economy, especially the rise of artificial intelligence, which has subverted the traditional business cycle. “We believe that investors should pay more attention to themes rather than broad asset classes because superpowers are reshaping the entire economy.” Analysts said, “We believe that the United States still stands out among other developed markets, thanks to stronger growth and the ability to better utilize superpowers. We have increased our overweight ratio in U.S. stocks and believe that the artificial intelligence theme will expand further.” However, BlackRock still has an underweight attitude towards U.S. bonds and expects bond yields to continue to rise in 2025 due to the Federal Reserve’s inability to take aggressive interest rate cuts.

Not all analysts are convinced that the U.S. economy can withstand the geopolitical uncertainty and unintended consequences of Trump’s proposed policies. Before Trump took office, he threatened to impose trade tariffs on almost every major economy in the world. While tariffs may help boost domestic manufacturing and support the dollar, these policies will come with costs and could exacerbate the ongoing threat of inflation. In this environment, fixed income analysts at TD Securities are slightly pessimistic about the U.S. and global economies and more dovish on U.S. interest rates, predicting that the Federal Reserve will cut interest rates four times by 2025, with the federal funds rate falling to 3.50% by the end of the year.

State Street’s 2024 study of gold ETFs shows that high-net-worth investors have nearly doubled their gold allocations over the past year, viewing it as a safe haven asset. State Street expects this trend to continue even as capital markets take a risk-on stance in 2025, with gold’s price support factors and its status as a safe haven continuing to boost its appeal as a core portfolio asset. Will a stronger dollar hurt gold? Gold is a dollar-denominated asset, so a strong dollar can sometimes be a headwind. But over the past few years, that pattern has been broken by unprecedented central bank buying. Since 2022, central banks are expected to have bought a total of 2,700 tons of gold, which is close to the fastest pace ever. Central banks have continued to buy even as the price of gold in dollar terms has soared over the past three years, suggesting they are more motivated by long-term strategic considerations and are not price sensitive. State Street expects central banks to continue to add to their gold reserves over the coming year.

Rising geopolitical tensions and efforts by some countries to reduce the dollar’s dominance in trade and global finance are also factors that should not be underestimated. In emerging markets in particular, central banks have been net buyers of gold for 15 consecutive years as a way to diversify their dollar-dominated reserves. The pace of these purchases began to accelerate when international trade relations deteriorated during Trump’s first term. This laid the foundation for more countries to see foreign exchange diversification as a national security issue. In 2022, after the United States “weaponized” the dollar through financial sanctions on Russia, central banks’ gold purchases were once again “accelerated”. Now, developed country central banks have also become open buyers of gold.

Another long-term driver of gold demand is the Asia-Pacific region. Over the past three decades, the region’s huge economic growth has boosted per capita incomes and spurred investment. From 1990 to 2023, Asia-Pacific’s GDP per capita has more than doubled, and its contribution to global GDP growth has increased from about a quarter to more than two-thirds. The number of gold funds in India and China has grown rapidly, sparking investor enthusiasm. In both countries, gold has important cultural significance and consumers have long viewed it as a store of value and a hedge against inflation. Since 2005, the number of gold funds in the Asia-Pacific region has grown from three to 128, attracting more than $23 billion in capital.

U.S. monetary and fiscal policy in 2025 could also influence the direction of gold. Until the exact size of tariffs and tax policies becomes clear, their true impact will not be known. The Fed predicts further rate cuts in 2025, but the exact number depends on the strength of the economy and the extent to which fiscal policy increases inflationary pressures and the federal deficit. Fiscal deficits driven by government borrowing and spending produce a set of economic conditions that favor gold. These conditions include high inflation expectations, currency depreciation, and increased uncertainty surrounding the government’s ability to repay its debts. When fiscal deficits occur simultaneously with an accommodative monetary environment, State Street expects that the opportunity cost of holding gold relative to buying Treasuries will decrease in 2025, enhancing its relative appeal as a safe-haven asset.

Gold prices could vary depending on changes in the Trump administration’s policies. State Street sees three possible scenarios: Base case (50% probability): Gold’s potential trading range is between $2,600 and $2,900 an ounce. Bullish case (30% probability): Gold prices will fluctuate between $2,900 and $3,100 an ounce. Bearish case (20% probability): If U.S. growth far exceeds expectations and the Trump administration’s pro-business measures boost the manufacturing sector, gold will fluctuate between $2,200 and $2,600 an ounce.