January Non-Farm Employment Report Outlook – In-depth Analysis of Market Expectations and Potential Impacts

- February 7, 2025

- Posted by: Macro Global Markets

- Category: News

Non-agricultural forecast outlook

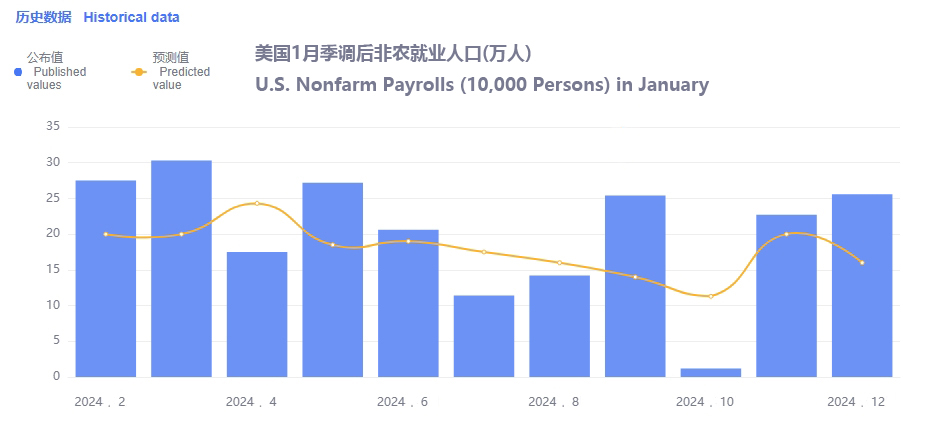

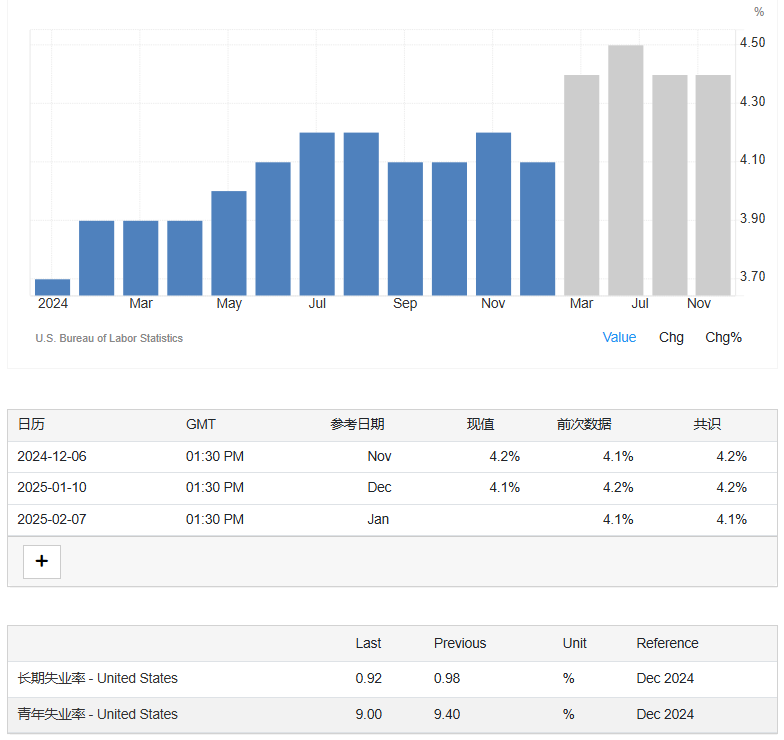

The number of non-farm payrolls in the United States increased significantly by 256,000 in December, far exceeding the market expectation of 160,000, and the unemployment rate also dropped from 4.2% to 4.1%, reflecting the continued hot job market. Although this data usually puts pressure on gold prices, gold rebounded quickly after a brief decline, with an increase of more than $30. Considering that December is the peak season for employment and is affected by natural disasters, it is expected that non-farm data will remain strong in the future. After the release of non-farm data, U.S. stocks performed poorly, U.S. bond yields rose, and the market’s expectations for the Fed’s interest rate cut in 2025 weakened. Some analysts even believe that the interest rate hike cycle may be restarted.

Powell previously said that in order to achieve the inflation target, there is no need to further weaken the labor market because the anti-inflation path remains solid. But he did not mention what would happen if the labor market unexpectedly tightened. Therefore, the focus of the market this week will be on the January non-farm payrolls report, and the market currently predicts that the number of new non-farm payrolls in January will be 170,000.

- Non-farm data released was lower than expected: the weak US job market is bad for the dollar and good for gold ;

- Non-farm data exceeded expectations: the US job market is good, bullish for the US dollar and bearish for gold .

Interpretation of non-agricultural forecast

The U.S. economy added 256,000 jobs in December, and while average hourly wage growth slowed, it remained close to 4% year-over-year. Strong job and wage growth could raise concerns that inflation could rise again in the coming months, especially in light of the tariffs Trump initiated on February 1. This could cause market participants to question again whether the Fed needs to cut interest rates twice this year.

On January 15, data released by the U.S. Bureau of Labor Statistics showed that the U.S. core CPI rose 3.2% year-on-year, slightly lower than the market expectation of 3.3%. Overall, U.S. inflation has continued to decline. The decline in inflation means that the Federal Reserve does not have to worry about excessively stimulating price increases when cutting interest rates, thereby affecting residents’ lives. This has increased the feasibility of interest rate cuts and promoted the rebound of the valuation center of global stock assets. According to the Chicago Mercantile Exchange’s “Federal Reserve Observation Tool”, the probability of the Federal Reserve cutting interest rates by 25 basis points in June has risen to 44.5%, becoming the mainstream expectation again; the probability of a 50 basis point interest rate cut in 2025 has also rebounded to 30.6%.

Currently, the US inflation rate is 2.7%, which is still far from the target of 2%, while consumers’ inflation expectations for the next five to ten years have risen to 3.3%. The probability of the Fed cutting interest rates in January has dropped to 2.7%, the probability of maintaining the current interest rate in March is 75.5%, and the probability of not cutting interest rates at all this year has risen to 25.3%. The market has formed an expectation of fewer and smaller interest rate cuts. From a macro perspective, the interest rate environment for global companies seems to be improving.

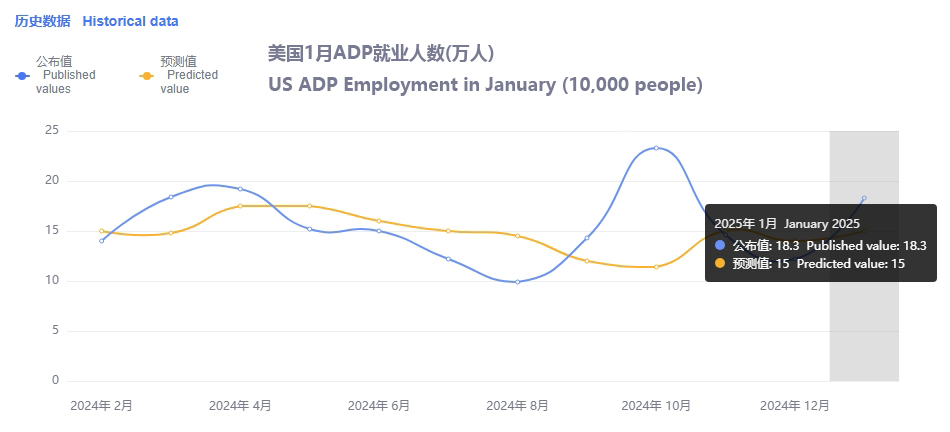

Analysis of the “Small Non-Farm” ADP Report

U.S. companies added more jobs than expected in January, showing that job growth remains strong despite uncertainty. The ADP report showed that U.S. private sector employment increased by 183,000 in January, higher than the revised 176,000 in December and higher than the market expectation of 150,000. The report further confirmed that the U.S. labor market is expanding at a healthy pace, with the six-month average employment increase reaching the fastest pace since early 2023.

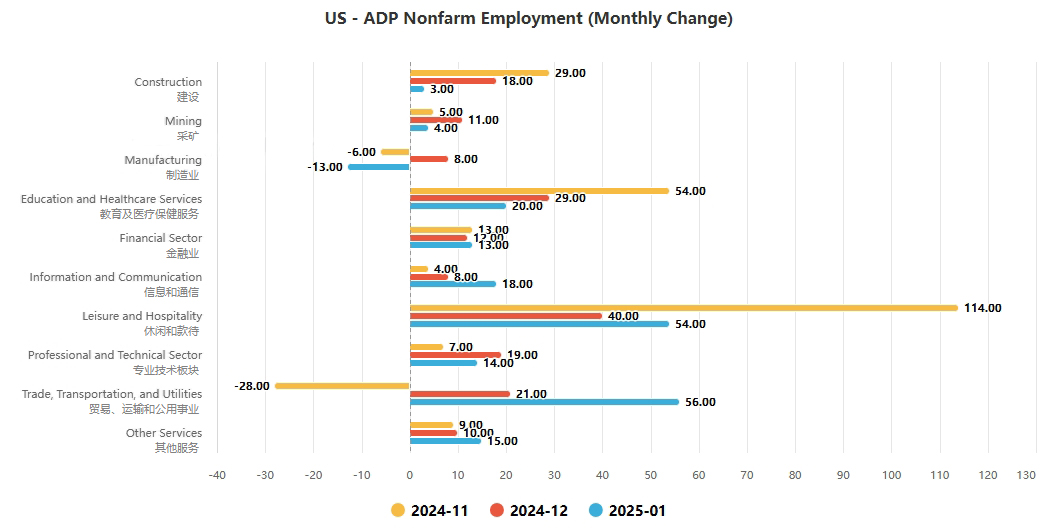

Although fewer job openings and slower wage growth show some signs of adjustment, employers are still hiring and layoffs remain mild. Federal Reserve officials are closely watching changes in the labor market to assess how deep to cut interest rates this year. The rapid rise in unemployment last summer was a key factor in pushing for a 1 percentage point rate cut in 2024, but the job market has since shown new vitality, with Fed Chairman Powell describing it last week as “fairly stable.” ADP Chief Economist Nella Richardson noted that job growth in January was concentrated in the service sector, especially trade, transportation, and leisure and hospitality, while job growth in business services and production was weaker. In addition, employment in construction and mining increased, but employment in manufacturing declined.

The report also showed steady wage growth, with wages for employees who changed jobs increasing by 6.8% year-on-year and wages for employees who stayed in their jobs increasing by 4.7%. Although the ADP report provides an important reference, the market focus may be more on the non-farm payrolls data to be released on Friday. The market generally expects that the number of non-farm payrolls in the United States will increase by 170,000 in January and the unemployment rate will remain at 4.1%. The forecast data sometimes differs greatly from the ADP report.

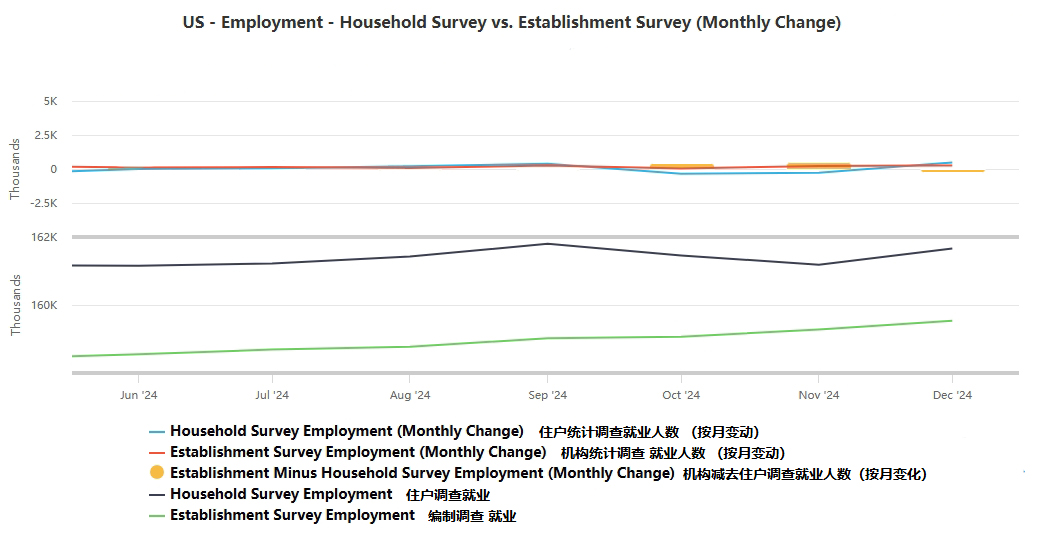

Goldman Sachs issued a special “warning”

for February 2025 shows that the US non-farm payrolls report will undergo a major adjustment. When the US Bureau of Labor Statistics (BLS) releases the January non-farm report on February 7, 2025, it will include an annual benchmark revision to the household survey. This revision will re-anchor the number of non-institutional residents to the latest census forecast, leading to revisions to indicators such as labor force and household employment. Non-farm data comes from business surveys and household surveys, the latter of which covers a wider range of employment, but has long been lower than business survey data.

Goldman Sachs pointed out that the census has underestimated population growth in the past few years, especially the immigration estimates for 2023-2024 failed to capture the recent immigration wave. In December last year, the census adjusted its estimation method and raised the net immigration estimate for 2021-2024 by 3.5 million, which is close to Goldman Sachs’ forecast. Goldman Sachs expects that the January employment report will show an increase of 3.5 million in the non-institutional resident population and 2.3 million in household employment, which is the largest revision in history, and data before 2025 will not be revised retroactively.

The revision will have a disproportionate impact on specific population groups. According to the 2023 American Community Survey, immigrants are more likely to be young Hispanics or Asians, and the revision will disproportionately increase the size of these groups. Because these groups have higher-than-average labor force participation and unemployment rates, the revision will increase overall labor force participation and unemployment rates. However, Goldman Sachs warned that because the Census Bureau did not take immigration status into account when allocating the revised population, it may lead to inaccurate estimates of labor force participation and unemployment rates, especially since the labor force participation rate of new immigrants is usually lower than that of non-immigrants.

After the revision, the total labor force is expected to increase by 2.5 million, household employment by 2.3 million, the labor force participation rate to rise by 11 basis points, and the unemployment rate to rise by 4 basis points. The U.S. Census Bureau expects population growth to return to normal in 2025, at about 1.9 million, and Goldman Sachs expects the population growth assumptions of the household survey to be consistent with this growth rate . This means that the non-agricultural will usher in the largest adjustment in history, and the unemployment rate may rise by 4 basis points !

Interpretation of gold and bank market trends

Affected by the tariff policy of US President Trump, gold has risen for five consecutive trading days, continuously setting new historical highs. Earlier, Trump said that he would impose tariffs on Canada, Mexico and China on February 1, which led to the rise of gold at the end of January, setting a new historical high. After that, Trump suspended the imposition of tariffs on Canada and Mexico and continued to impose tariffs on China, which led to a sharp drop in the US dollar, creating an opportunity for gold to rise further on Monday. On Tuesday, China announced measures to impose tariffs on the United States, and the Sino-US trade dispute intensified. Strong safe-haven buying supported gold to continue to rise sharply on Tuesday and Wednesday.

Gold trend analysis:

On the daily chart, gold has set new historical highs for 5 consecutive days, and its short-term performance is very strong. For the support below, pay attention to the position of $2,860 where the gold price rose and fell back to stabilize on Wednesday, followed by the high of $2,845 on Tuesday; for the pressure above, the gold price in the Asian and European sessions on Wednesday was mainly under pressure at $2,872, followed by the historical high of $2,882. If it continues to break through, pay attention to the integer position of $2,900. The 5-day moving average and the MACD indicator cross upward, the RSI indicator crosses upward and enters the overbought area, and the KDJ indicator crosses slightly downward in the overbought area. The technical bulls continue to maintain their advantages, and it is necessary to pay attention to the risk of short-term overbought adjustments.

Silver trend analysis:

Technically, silver’s price action remains tightly constrained, but a breakout looks increasingly likely as the market digests the Fed’s stance and Trump’s economic policies. If Powell suggests that rate cuts remain a distant prospect, silver could face near-term resistance with downside targets at $29.50 and $29.00. However, any dovish comments from the Fed could push silver above $30.98, paving the way for gains toward $31.81 and above. Traders should brace for heightened volatility following the Fed’s decision, with silver’s next move largely dependent on Powell’s tone and any unexpected developments from the White House.