June CPI data released today: The game between tariff shocks and expectations of interest rate cuts, the gold market holds its breath as it waits

- July 15, 2025

- Posted by: Macro Global Markets

- Category: News

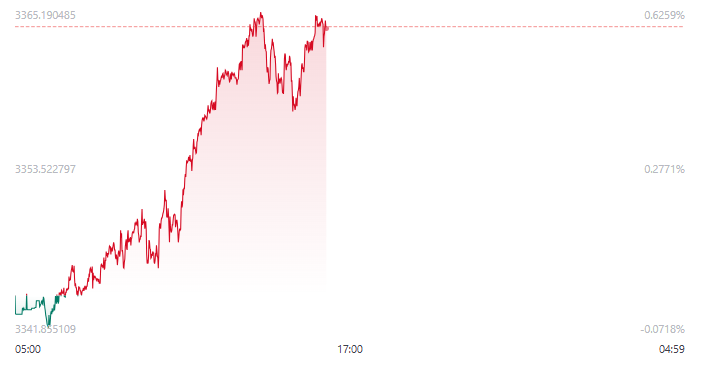

As of the morning session of July 15th in the Asian market, spot gold prices were reported at $3345.22 per ounce, a drop of nearly $30 from yesterday’s high of $3374.78. The market is full of expectations for the US June CPI data to be released at 20:30 in the evening. This data will be a key point in verifying whether Trump’s tariff policy has actually pushed up inflation, while directly affecting market expectations for the Fed’s September interest rate cut. According to authoritative institutions’ predictions, the overall year-on-year increase in CPI in June may reach 2.7%, and the core CPI may climb to 3.0%, setting a new six-month high.

1、 Can the tariff impact be reflected in the June CPI?

The 30% tariffs imposed by the Trump administration on countries such as the European Union and Mexico since April have theoretically been transmitted through the supply chain to the consumer end. Nomura Global Macro Research Director Su Bowen pointed out that although companies have buffered the impact of tariffs by hoarding inventory in the early stage, the rising cost of imported goods will gradually be reflected in prices as the June replenishment cycle begins. Data shows that the US manufacturing PMI price index rose to 58.2 in June, reaching an 8-month high. The prices of tariff sensitive goods such as clothing and automotive parts increased by over 1.5% month on month.

However, there are differences in the actual impact of tariffs on the market. The minutes of the Federal Reserve’s June meeting showed that most officials believe that the tariff shock may be “temporary or moderate,” but if companies are unable to absorb costs through supply chain adjustments, inflationary pressures may continue. Atlanta Fed President Bostic warns that if the tariff policy continues until 2026, the core CPI may increase by an additional 0.8 percentage points, forcing the Fed to postpone interest rate cuts.

2、 How does CPI data affect the expectation of a September interest rate cut?

The current federal funds rate futures show that the market’s expected probability of a September rate cut has dropped to 48%, a decrease of 12 percentage points from last week. If the June CPI meets or exceeds expectations, it may further strengthen the Federal Reserve’s stance on maintaining high interest rates. Nomura predicts that if the core CPI exceeds 3.0% year-on-year, the Federal Reserve may postpone the first interest rate cut to December, reducing the annual rate cut to 25 basis points.

On the contrary, if the CPI data is lower than expected, there may be renewed hope for interest rate cuts. According to analysis by Wells Fargo, if the core CPI only rises by 0.2% month on month, the market may bet on a 50 basis point interest rate cut in September, pushing the US dollar index back below 97.5. It is worth noting that the Trump administration has been frequently pressuring the Federal Reserve in recent times, even threatening to replace Powell on the grounds of overspending on the renovation cost of the headquarters building. This political intervention may amplify market volatility after the data is released.

3、 The gold market: a key game under the interweaving of long and short factors

The short-term trend of gold is highly correlated with CPI data. On a technical level, gold prices are facing strong resistance around $3375. If the strong CPI data leads to the US dollar index breaking through 98.5, it may trigger a drop in gold prices to the support level of $3320. On the contrary, if the weak CPI triggers an increase in expectations of interest rate cuts, gold prices are expected to rise above the resistance range of $3380.

In the long run, the risk of stagflation caused by tariffs and the global trend of central bank gold purchases remain the core support for gold. The People’s Bank of China has increased its holdings of gold for eight consecutive months, with reserves reaching 73.9 million ounces at the end of June. 95% of central banks worldwide plan to continue increasing their holdings in the next 12 months. According to data from the World Gold Council, the net inflow of gold ETFs in June reached a three-month high of 12.3 tons, reflecting institutional demand for inflation hedging.

4、 Historical experience reference

From historical data, for every 0.1 percentage point increase in CPI year-on-year that exceeds expectations, the average daily volatility of gold increases by 1.2%. For example, when the CPI increased by 5.4% year-on-year in June 2023, the daily fluctuation of gold prices reached $42.

However, we need to be vigilant about the risks of policy shifts. If the Federal Reserve sends a dovish signal after the release of CPI data, or if Trump announces a suspension of tariffs, gold may face downward pressure of $50-80. Citigroup warns that the current gold price has partially overdrawn expectations of interest rate cuts. If the September interest rate cut fails, it may trigger long profit taking.

The June CPI data will become a “stress test” to verify the impact of tariffs, and its results will not only determine the policy path of the Federal Reserve, but also reshape the long short pattern of the gold market.