Pressure on Asian currencies and volatility in the U.S. bond market , waves in a strong dollar environment

- January 8, 2025

- Posted by: Macro Global Markets

- Category: News

Asian currencies have generally fallen to their lowest point in 20 years recently, mainly affected by the strong growth of the US dollar and the vow of US President-elect Trump to raise tariffs. The Bloomberg Asian Currency Index fell to 89.0409 on Monday, the lowest level since 2006. Federal Reserve officials are cautious about the path of interest rates, and investors are worried that Trump’s tariff policy may lead to inflationary pressures. These factors have combined to suppress Asian currencies from the broad rise of the US dollar .

The dollar will continue to rise across the board against Asian currencies, but some pairs will rise more sharply. He pointed out that if U.S. trade protectionism becomes a reality, it will be a huge game changer. Asian central banks may respond to such protectionism by allowing their currencies to depreciate in a controlled manner.

The South Korean won fell to a 15-year low in December, while the Indian rupee also fell to a record low. Other Asian currencies, such as the Indonesian rupiah, ringgit and Thai baht, have also fallen against the dollar recently, although they are still some distance away from the historical lows during the Asian financial crisis in 1998. In an effort to protect its currency, the Philippine central bank increased its support for currency markets last month, while the Indonesian central bank vowed to “boldly” protect the rupiah . On Monday, the Indian rupee fell below 85.8075 per dollar, hitting an all-time low. Among the Group of Ten (G10) currencies, the yen led the decline against the dollar, while the Canadian dollar was boosted by a report in the Globe and Mail that Trudeau is likely to announce his resignation as leader of the Liberal Party this week . RBC Capital Markets believes that the Canadian dollar’s gains may be short-lived given the currency’s “bearish macro backdrop . ”

Meanwhile, Trump “refuted rumors” on social media, with The Washington Post reporting that reports that Trump’s aides were exploring a tariff plan that would apply to “all countries” but only cover key imports were false. This statement caused the US dollar index to rise 50 points in the short term, spot gold to fall nearly $13 in the short term, and non-US currencies to give up some of their gains during the day, marking a sharp narrowing of the 10% to 20% general tariffs proposed by Trump during the campaign . Investors have therefore increased their bets on the Fed’s rate cuts, as speculation has it that the new plan will not exacerbate inflation like previous broad tariff proposals . Affected by the news, the US dollar index continued to fall, losing the 108 mark, and fell nearly 1% during the day. Spot gold turned higher during the day, once approaching the $2,650 mark. Non-US currencies also collectively counterattacked, with the pound against the US dollar, the euro against the US dollar, the New Zealand dollar against the US dollar, and the Australian dollar against the US dollar rising by more than 1%, and the US dollar against the Japanese yen erasing its gains during the day. The offshore renminbi continued to strengthen against the US dollar, rising above the 7.33 mark, and rising nearly 300 points during the day .

Despite the lack of clarity on Trump’s tariff plans, some companies have already started stockpiling goods in advance, looking for new suppliers and renegotiating contracts, causing a surge in imports and supply chain disruptions. Bloomberg Economics’ base case last year was for three waves of tariff increases in the U.S. starting in the summer of 2025, with tariffs on Chinese goods ultimately tripling by the end of 2026, and smaller tariff increases on the rest of the world—mostly on intermediate and capital goods that don’t directly affect consumer prices . At the start of 2025, bond traders’ expectations for U.S. Treasuries were lower, driven by the resilience of the U.S. economy and President-elect Trump’s threats of tax cuts and tariffs. Strong economic data, Trump’s big Republican victory and cautious comments from Federal Reserve officials have triggered a downturn in the U.S. Treasury market, and investors are recalibrating their expectations for the Fed .

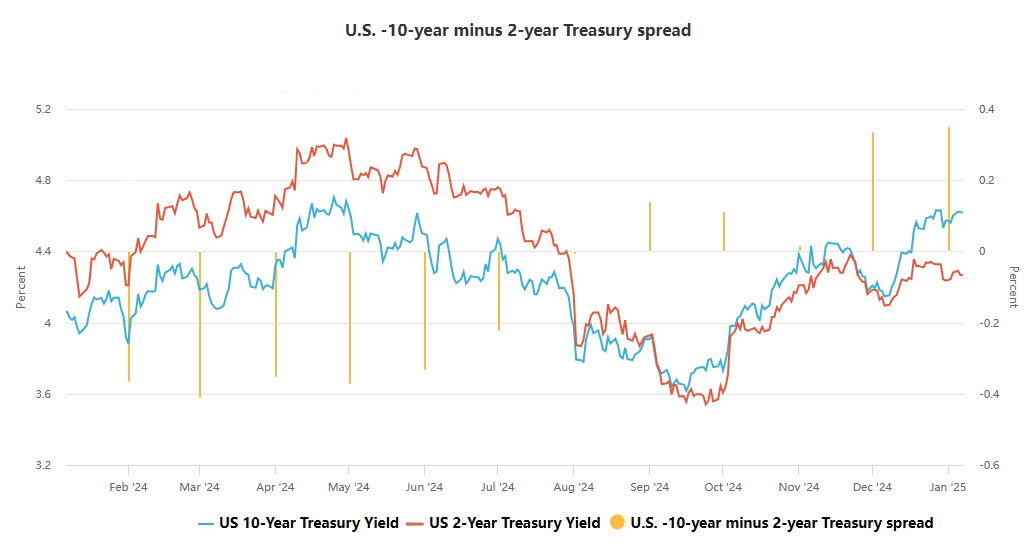

The U.S. government is set to issue $119 billion in new bonds this week, and markets are uneasy about it. On Monday, the U.S. will sell $58 billion in three-year Treasury notes, and will auction 10-year and 30-year bonds on Tuesday and Wednesday, respectively. Due to the state funeral of former U.S. President Carter on Thursday, the auction days of this round of U.S. Treasury bonds were moved up a day. The adjustment hit longer-term U.S. bonds the hardest, with the benchmark 10-year Treasury yield rising to more than 4.6%, about a percentage point higher than the level when the Federal Reserve first began to ease monetary policy in September. The yield on the 30-year Treasury bond rose to 4.85%, the highest level since the end of 2023. The fluctuations in the two-year Treasury bond were more moderate, reflecting investors’ shift to bonds that are more affected by the Federal Reserve’s policy rate .

Priya Misra, portfolio manager at JPMorgan Asset Management, pointed out that market concerns about inflation mainly stem from factors such as tariffs, fiscal stimulus and immigration, while optimistic expectations for economic growth come from fiscal stimulus and deregulation, which has led to rising interest rates and a bearish outlook for the bond market. At the same time, Trump’s tax cuts and tariff policies may exacerbate inflationary pressures and increase the supply of U.S. Treasuries. Jack McIntyre, portfolio manager at Brandywine Global Investment Management, suggested that it is more prudent to hold short-term U.S. Treasuries at present because the economy is still growing and U.S. Treasury yields have risen. Futures traders expect the Federal Reserve to keep interest rates unchanged until June and only cut the benchmark rate by 50 basis points in 2025. If Trump fulfills his policy commitments, U.S. Treasury yields may rise, but the range is limited and is not expected to exceed 5% .

Meanwhile, Fed Governor Tim Cook said on Monday that the Fed can proceed cautiously in further rate cuts given that the economy is solid and inflation is proving more stubborn than previously expected . Since the Fed began cutting its benchmark rate in September, “labor market resiliency has increased, while inflation has been more stubborn than I expected at the time,” Cook said in a speech at the University of Michigan Law School. “So I think we can be more cautious in making further rate cuts.” The Fed cut its policy rate by a full percentage point in its last three meetings through 2024, but markets expect the Fed to keep its policy rate in the current range of 4.25% to 4.5% at its next meeting on January 28-29 .

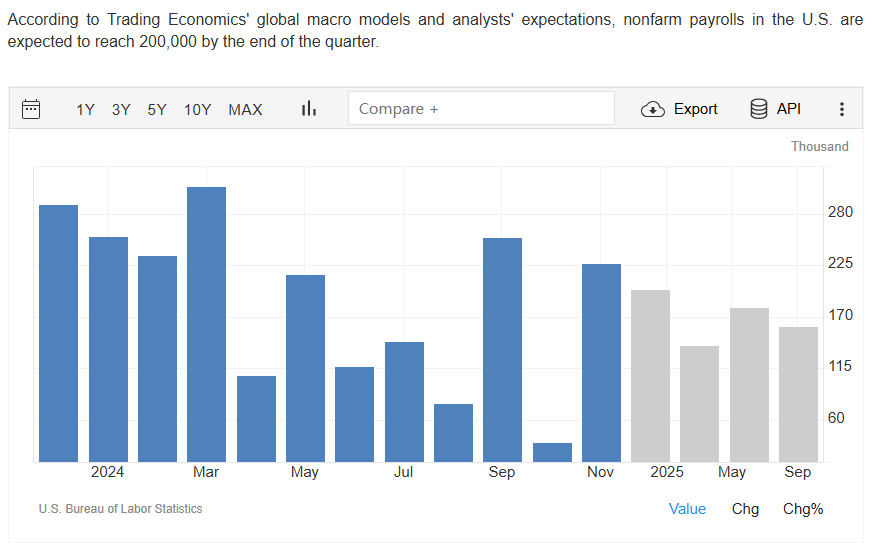

On Friday, the Labor Department will release its latest nonfarm payrolls report, which is expected to show 160,000 new jobs in December, down slightly from the 227,000 jobs added in the previous month. “The weak data will rekindle discussions about the possibility of a Fed rate cut in March,” said JPMorgan’s Misra. Overall , the trend of the U.S. bond market in 2025 will be affected by economic resilience, Trump’s policies, and the Federal Reserve’s monetary policy. Investors will pay close attention to the U.S. nonfarm payrolls data for December released on Friday for further signs of U.S. economic growth. At the same time, the market has reduced its bets on the Fed’s rate cuts this year to seize investment opportunities and avoid risks .

In 2025, the global economy and financial markets will continue to face multiple challenges. Asian currencies are under pressure from the strong dollar and the uncertainty of Trump’s tariff policy, while the U.S. bond market is affected by the resilience of the U.S. economy, inflation expectations and policy changes. Investors need to pay close attention to economic data, policy trends and changes in market sentiment to cope with possible fluctuations and uncertainties.