Trump’s major shift in energy policy : Unleashing fossil fuels and reshaping the global energy landscape

- January 21, 2025

- Posted by: Macro Global Markets

- Category: News

Trump plans to take a series of actions immediately after his inauguration, using emergency powers to free up U.S. domestic energy production while reversing the Biden administration’s actions to combat climate change, according to people familiar with the matter. The shift is aimed at fulfilling his campaign promise to increase domestic energy production and reorient federal government policy to support oil and gas production, in stark contrast to the Biden administration’s efforts to curb fossil fuels.

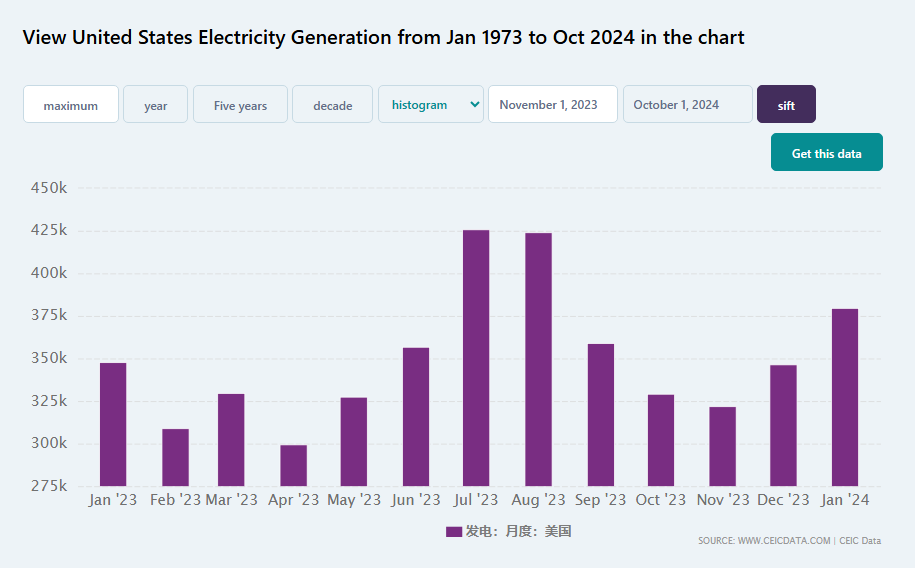

Trump vowed during his campaign to declare a national energy emergency, saying it was necessary to increase production and cope with the rapid growth in demand brought about by the rapid development of artificial intelligence. According to a report by the Brennan Center for Justice, declaring a national emergency allows the president to use up to 150 special powers that are usually used to respond to hurricanes, terrorist attacks and other unforeseen events. However, it is unclear whether Trump can successfully use these powers to achieve his goal of building more power plants.

This time, he is expected to use executive power extensively, including lifting the moratorium on new U.S. liquefied natural gas export permits, revoking measures implemented by Biden, and cutting federal incentives for electric vehicles. To promote new oil and gas development on federal lands, while directing the revocation of Biden-era climate regulations and the decision to remove approximately 625 million acres of U.S. waters from the status available for oil and gas leasing. Biden’s announcement has already sparked legal challenges from the American Petroleum Institute, Alaska, and several states, but the legality of Trump’s reversal of this decision may also need to be determined by a federal court.

This will involve all aspects of the U.S. energy industry, from oil fields to car dealerships. He will also push to roll back a set of strict government regulations covering vehicle pollution and fuel economy, which he calls “electric vehicle accountability.” Asian fossil fuel buyers, seeking to appease the incoming Trump, have concluded that buying more U.S. oil and gas can increase their bargaining power in tariff negotiations with the Trump administration. Trump’s threats to impose tariffs on several countries that have trade surpluses with the United States have prompted policymakers in South Korea, Vietnam and the European Union to consider purchasing more energy from the United States.

The United States’ trading partners generally view purchasing U.S. LNG as a boon to tariff negotiations with the Trump administration. Since Trump’s election, there has been a clear and rapid shift toward securing U.S. supplies. This shift will allow Trump to deliver on the full return to fossil fuels he promised his voters, not only by expanding U.S. LNG exports beyond the planned goal of doubling them by 2030, but also by giving U.S. project developers an edge over rival exporters.

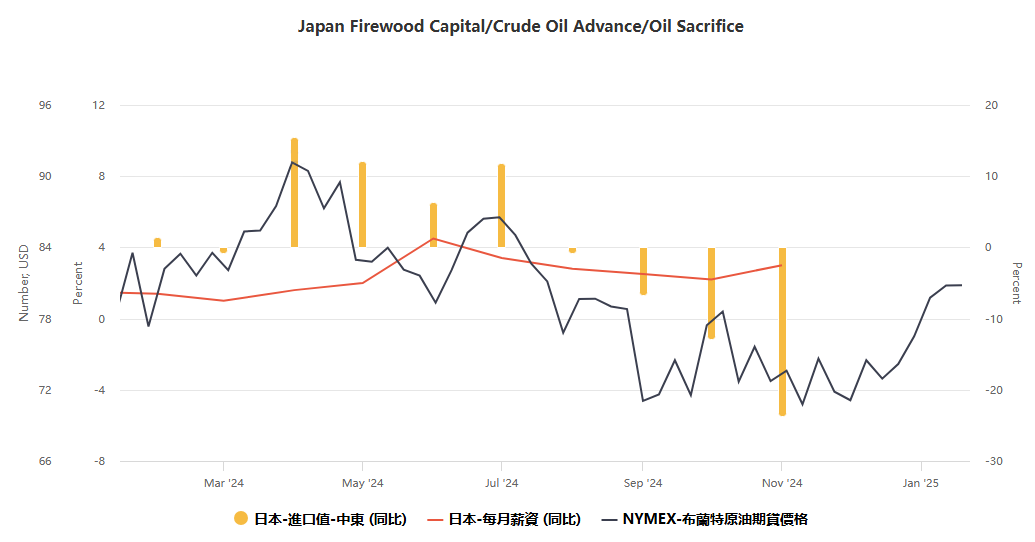

Kazuhiro Ikebe, president of Japan’s Kyushu Electric Power Co., said increased U.S. LNG production is “good news” for the utility industry because it could stabilize prices. Buyers have been dealing with volatile gas prices since the outbreak of the Russia-Ukraine conflict in 2022. Buyers in countries including Japan and Thailand have reopened negotiations with U.S. LNG export projects in the past few months, and traders involved in the talks said they are willing to sign deals with the United States if the price is right.

About half of U.S. liquefied natural gas exports went to Europe last year, according to ship tracking data compiled by Bloomberg. The loss of Russian pipeline gas flows at the beginning of the year means the continent may also turn to U.S. supplies to make up the shortfall. Last month, Trump warned the European Union that its goods would be hit with U.S. tariffs if its members did not buy more American oil and gas.

However, the market is unlikely to see any immediate impact. Importers cannot easily increase purchases from the United States in the coming years because much of the country’s current production is tied up in long-term contracts. Instead, traders negotiating with U.S. exporters say they are looking at locking in billions of dollars worth of supplies, without which proposed U.S. projects, which will take years to build, cannot proceed. Even the long-delayed Alaska liquefied natural gas project, which has been in the works for more than a decade, could move forward under Trump.

The new government is also expected to use the country’s dominance in liquefied natural gas to gain benefits in other areas, such as in escalating trade wars with foreign countries. European Commission President Ursula von der Leyen quickly discussed liquefied natural gas exports with Trump after his election victory in November last year, saying that the U.S. fuel could help replace Europe’s still-strong Russian supplies. South Korean Minister of Trade, Industry and Energy Ahn De-gun also said: “Other countries are talking about how to reduce the growing trade deficit during the Trump administration. Everyone is saying they want American energy.”

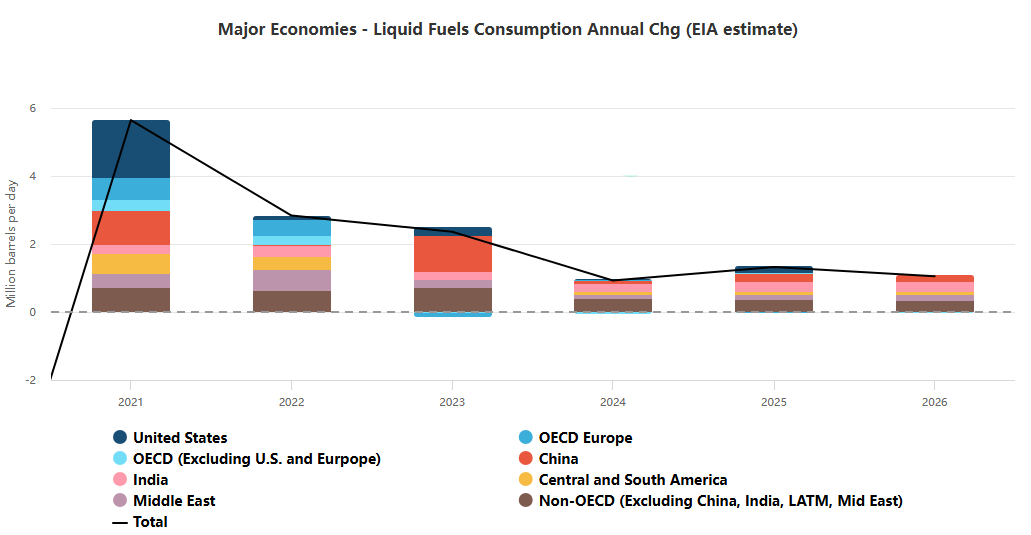

Overall, the Trump administration’s energy policy shift aims to reshape the US domestic energy landscape, consolidate its global energy dominance, release domestic energy production, support oil and gas development, and withdraw the Biden administration’s climate regulations and electric vehicle incentives. This policy not only fulfills Trump’s campaign promises, but also enhances the competitiveness of the United States in the global energy market by expanding liquefied natural gas exports. At the same time, it forces Asian and European buyers to increase their purchases of US energy in response to tariff threats, which not only stabilizes natural gas prices, but also provides the United States with bargaining chips in the trade war. However, this policy has also aroused concerns among environmentalists, and its legality may face court review, and its market impact will be limited in the short term.