Trump’s new tariff policy triggers a safe haven trend, with gold soaring $30 in a single day

- March 5, 2025

- Posted by: Macro Global Markets

- Category: News

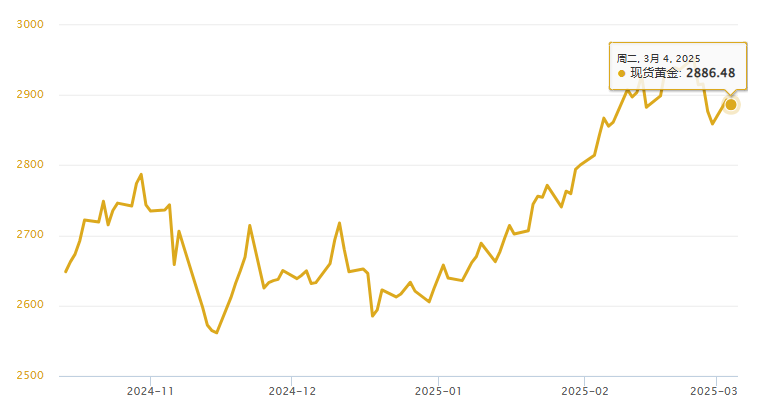

On Tuesday (March 4th), US President Trump announced the implementation of a comprehensive 25% additional tariff on Canadian and Mexican goods imported to the United States, covering key areas such as automotive parts, agricultural products, and energy products, with an annual trade volume of 387 billion US dollars. Affected by this, the Mexican peso exchange rate plummeted 5.7% to a new low since the 1994 currency crisis, the inverted yield curve of US Treasury bonds deepened to -0.37%, and spot gold surged $30 in a single day, touching $2894.9 per ounce.

The tariff escalation this time targets the automotive industry chain (with an annual export value of $92 billion in Mexican parts to the United States), Canadian cork wood (accounting for 23% of exports to the United States), and crude oil and electricity (accounting for 12% of imports to the United States). The US Chamber of Commerce estimates that it will push up local inflation by 0.8 percentage points and cause 350000 job losses. The resurgence of stagflation expectations has increased the sensitivity of gold to the “stagflation risk premium” to a historical extreme of 1.87, and the industrial metals index has fallen 4.2% in response.

Market hedging demand shows explosive growth

The Chicago Panic Index (VIX) surged 42% in a single day, setting a record since March 2020. The world’s largest gold ETF (GLD) grossed $1.47 billion in a single day, breaking its 21 year peak. London spot gold trading volume surged to 4.3 times the daily average. A key breakthrough has been made in the technical aspect, with gold prices breaking through the weekly head, shoulder, bottom, and neck line of $2935. COMEX’s open interest contracts have surged by 28%, and JPMorgan Chase’s main contract holdings have increased by 17000 lots, betting on a breakthrough of $3000 in the second quarter. The position of call options at $2950 has accumulated to a historical peak, and the technical target level has moved up to $3120.

Divergence or consensus in institutional strategies

Goldman Sachs warns that if tariffs push up core PCE inflation above 3.5%, it will trigger a “stagflation driven bull market,” with a three-month target price raised to $3050; Citi’s quantitative model suggests that the negative correlation between gold and the S&P 500 has risen to -0.73, and it is recommended to increase the allocation ratio from 5% to 12%; Swiss Baosheng technical analysis emphasizes that any pullback below 2900 after breaking the $2935 level is a buying opportunity, with a stop loss set at $2870 and a medium-term target pointing towards the historical channel of $3150. The risk dimension presents multiple games. Canada’s urgent lawsuit submitted to the WTO may trigger a 50% retracement of gains, and the divergence of US and European monetary policies may push the US dollar to the 107 level to suppress gold prices. The current 30 day volatility of gold has risen to an extreme level of 35%, and short-term capital profit taking risks have intensified the volatility intensity.

Conclusion

This tariff storm once again verifies the ultimate defensive value of gold in the black swan event, as the collision between the ebb of globalization and resource nationalism has given rise to a rare resonance between monetary and commodity attributes. When technology breaks through and fundamentals drive together, gold is standing at the historic threshold of hitting $3000. It is recommended that investors seize the opportunity to build positions in batches within the range of $2900-2950.

As of 10:00 Beijing time, the spot gold price is 2886.48 US dollars per ounce.

Trading risk warning: Any investment carries risks, including the risk of financial loss. This suggestion does not constitute specific investment advice, and investors should make decisions based on their risk tolerance, investment goals, and market conditions.