Trump’s tough stance on Iran’s nuclear issue has led to a surge in demand for safe haven gold! Can bulls break through key resistance?

- July 1, 2025

- Posted by: Macro Global Markets

- Category: News

On June 29th local time, US President Trump announced on social media “Real Social” that the United States has completely destroyed Iran’s three nuclear facilities in Fordo, Natanz, and Isfahan, and has made it clear that “sanctions against Iran will not be lifted,” while warning that “if Iran continues to provoke, it will bomb its nuclear facilities again.

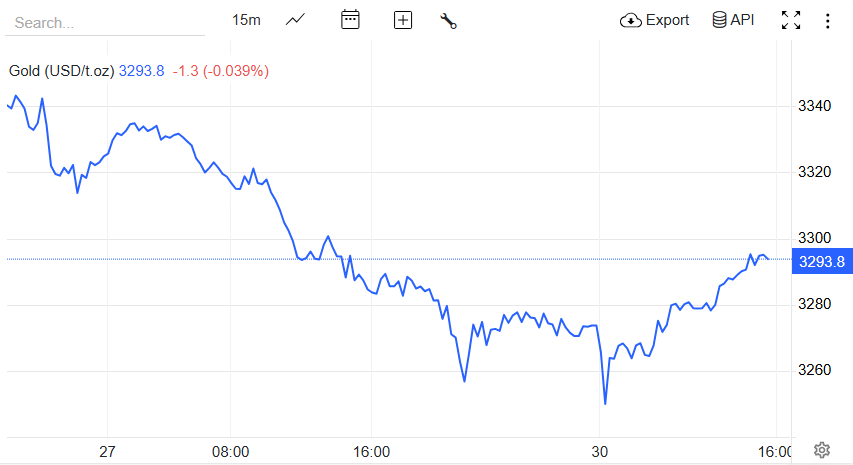

This statement completely shattered the market’s expectations for the US Iran nuclear negotiations. The Iranian Ministry of Foreign Affairs urgently sent a letter to the United Nations Security Council on the same day, demanding that the US and Israel be held accountable for their “aggression” and vowing to “reserve all countermeasures”. Driven by the escalation of geopolitical risks, spot gold surged 0.6% to $3293.4 per ounce in early Asian trading on June 30th. However, it later fell back to around $3269 due to market digestion of expectations of “longer high interest rates”, and then rose to around $3293.9 per ounce in midday trading, approaching the 3300 mark.

1、 Trump’s’ Extreme Pressure ‘: Dual Use of Sanctions and Threat of Force

The controversy over the destruction of nuclear facilities and the struggle between the United States and Iran

In his speech on June 29th, Trump claimed that the US attack on Iran’s nuclear facilities had “flattened it”, but on the same day, the Director General of the International Atomic Energy Agency, Grossi, stated that Iran still has the ability to “resume uranium enrichment activities within a few months” and called on all parties to return to the negotiating table. The Central Command of Hattam Abia in Iran responded by stating that Iran is prepared to “respond to any aggression” and demonstrated advanced military equipment developed domestically. The disagreement between the two sides over the extent of damage to nuclear facilities highlights the risk of prolonged conflict.

The Shift of Sanctions Policy and Economic Game

Trump made it clear in an interview with Fox News on June 29th that “lifting sanctions will only be considered if Iran completely abandons its nuclear program and proves its peaceful intentions. This position is in stark contrast to the indirect negotiations between the United States and Iran that began in April – the two sides had previously held five rounds of talks on “Iran’s uranium enrichment restrictions in exchange for sanctions lifting”, but were deadlocked due to the United States’ demand for “complete denuclearization”. Analysts point out that the Trump administration’s move aims to force Iran to make concessions on the nuclear issue through a dual track strategy of military deterrence and economic blockade.

2、 Geopolitical risk escalation: Gold’s safe haven attribute is being tested again

Short term volatility

The sudden escalation of geopolitical conflicts has led to severe fluctuations in the gold market. On June 30th, spot gold surged to $3289 in the short term after the data was released, but then fell back to $3269 due to the rebound of the US dollar index (DXY rose 0.3%), closing down 0.2%.

Comparison of Historical Cases and Market Reactions

Looking back at the escalation of the US Iran conflict in January 2020, the price of gold surged 4.5% within 24 hours of the attack on Sulaimani, breaking through $1610 per ounce. Although the current conflict has not reached the level of a ‘hot war’, the escalation of direct military intervention by the United States (such as the June 21 airstrike) has raised concerns in the market about the ‘situation in the Middle East getting out of control’. According to research by Deutsche Bank, the geopolitical risk premium of gold typically peaks on the 8-20 trading days after a crisis, with an average increase of 5.5%. The current pullback may be a “bullish entry opportunity”.

3、 The dual game in the gold market: the struggle between inflation and interest rates

Inflation stickiness and Federal Reserve policy expectations

Despite geopolitical risks driving up safe haven demand, the hawkish stance of the Federal Reserve still exerts pressure on gold. The core PCE price index rose to 2.7% year-on-year in May, reaching a new high since February 2025. The market’s probability of a rate cut in September has fallen from 71% in early June to 58%. UBS pointed out that if the Federal Reserve delays or even restarts interest rate cuts, an increase in real interest rates will weaken the attractiveness of gold, but the “risk of US economic recession” still provides bottom line support for gold prices.

Global central bank purchases of gold and weakening of the US dollar’s position

According to data from the World Gold Council, 95% of surveyed central banks plan to continue increasing their holdings of gold in the next 12 months, with particularly strong purchasing intentions among emerging market central banks. Meanwhile, the official forum of international monetary and financial institutions (OMFIF) reports that the proportion of the US dollar in global foreign exchange reserves has decreased from 58% in 2024 to 52%, with gold becoming the main beneficiary of “de dollarization”. This trend provides long-term structural support for gold.

Trump’s tough stance on Iran’s nuclear facilities has pushed geopolitical risks to a new critical point. Despite being suppressed by the hawkish stance of the Federal Reserve in the short term, the global trend of central bank gold purchases, the weakening of the US dollar’s position, and the risk of economic recession in the United States still provide long-term action for gold prices.