U.S. housing costs have become a driver of inflation data, and the market has reacted violently to the Fed’s policies !

- February 14, 2025

- Posted by: Macro Global Markets

- Category: News

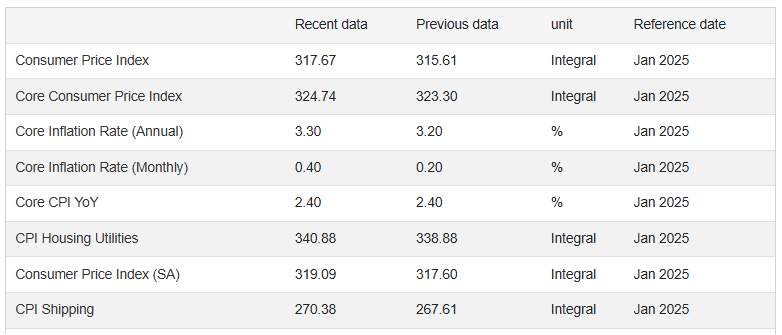

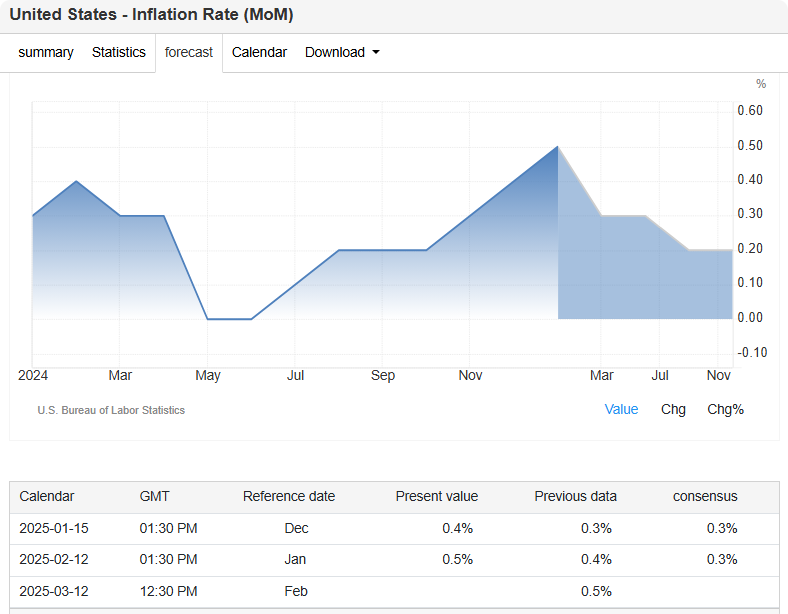

The increase in U.S. inflation last month exceeded expectations across the board, supporting the Federal Reserve’s cautious attitude towards rate cuts. Data released by the U.S. Bureau of Labor Statistics on Wednesday showed that the core CPI, which excludes food and energy costs, accelerated to 0.4% month-on-month in January, the largest increase since March 2024, exceeding expectations of 0.3% and the previous value of 0.2%; the year-on-year growth rate accelerated to 3.3%, higher than the expected 3.1% and the previous value of 3.2%. The overall CPI accelerated to 0.5% month-on-month, the largest increase since June 2024, higher than the expected 0.3% and the previous value of 0.4%, and the year-on-year growth rate returned to the “three-digit” at 3%, higher than the previous value and market expectations of 2.9%.

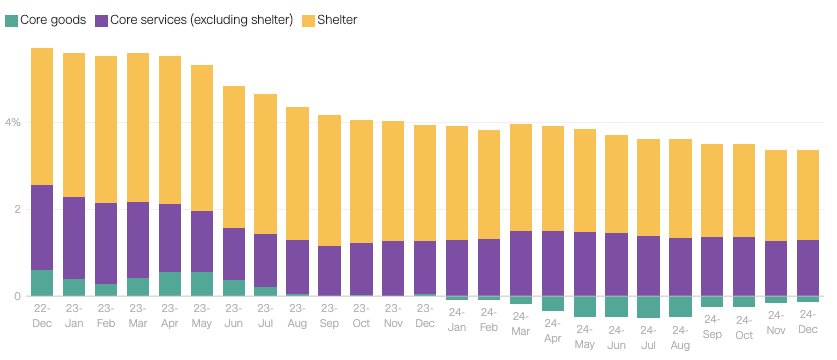

The Bureau of Labor Statistics said that housing costs continue to be a problem for inflation, rising 0.4% that month, accounting for about 30% of the total CPI increase. Home prices across the United States are still rising at a faster rate than overall inflation, which has shocked homebuyers. When talking about inflation, Federal Reserve Chairman Powell previously said that housing is the main source of the gap between inflation and the target. The annual rate of unadjusted housing inflation in the United States in January was 4.4%, compared with 4.6% in the previous month. This is one of the important reasons why overall inflation has not fallen to the Fed’s ideal target of 2%.

Last fall, the Federal Reserve began to cut interest rates from a 23-year high, and some experts were even ready to declare the Fed a victory in the fight against historic inflation. However, since the Fed’s first rate cut in September last year, the U.S. government’s two main inflation measures – CPI and PCE inflation – have remained stubbornly above 2%. Housing inflation measures the valuation of rents when homeowners live in their homes. The two indicators measure inflation for owned and rented homes in the United States, respectively, and together account for more than 33% of the total weight of the CPI.

If housing inflation remains high, overall inflation will also remain high. “Proportionately, housing accounts for a large portion of the CPI market basket,” said Erica Groshen, former director of the Bureau of Labor Statistics. “And it does move more sluggishly, there’s no doubt about that.” In contrast, housing has a smaller weight in the Fed’s preferred inflation measure, PCE, accounting for less than 20%. Rising home prices have spread to most parts of the country. The National Association of Realtors reported that in the fourth quarter of 2024, 89% of metropolitan areas saw an increase in single-family home sales prices. This is partly due to the fact that mortgage rates are still high, and many homeowners who locked in loans during low-rate periods are reluctant to sell their properties, resulting in fewer houses on the market. In addition, a long-term lack of home construction has also caused a shortage of new homes, further pushing up house prices.

Despite the Federal Reserve’s rate cuts, mortgage rates remain high, weakening homebuyers’ ability to pay. Fannie Mae data showed that the average rate for a 30-year fixed mortgage in the United States was 6.89% last week, which was slightly lower than 7.04% in January, but still higher than the average level in the 14 years before 2022. However, prices in the rental market have shown signs of stabilization. According to Redfin data, the median rent in the United States fell 0.3% year-on-year to $1,594 in December 2023, the lowest level since March 2022.

After the data was released, spot gold fell more than $10 in the short term, and then rebounded strongly to return to above the $2,880 mark; the US dollar index rose 50 points in the short term and basically remained strong; non-US currencies fell across the board, with the euro falling 40 points against the US dollar in the short term; the pound fell nearly 70 points against the US dollar in the short term; the US dollar rose nearly 120 points against the Japanese yen in the short term; and US bonds suffered a sharp sell-off. The Bureau of Labor Statistics said that food prices rose 0.4%, driven by a 15.2% increase in egg prices. The bureau said this was the largest increase in egg prices since June 2015, and about two-thirds of the increase in domestic food prices was caused by eggs. US egg prices have soared 53% in the past year.

Notably, the Bureau of Labor Statistics updated its weights and seasonal adjustment factors, which are the models the government uses to remove seasonal fluctuations from the data to reflect price changes in 2024. Last month’s increase in the CPI may partly reflect price increases driven by businesses at the beginning of the year. Businesses may also preemptively raise prices in anticipation of higher and more widespread tariffs on imported goods. The core CPI rose in January, which economists said showed that even after seasonal adjustments, seasonal effects are still lingering in the data.

Wednesday’s CPI report is further evidence that the current U.S. anti-inflationary march is in danger of reversing, which, combined with a strong labor market, could keep the Federal Reserve on hold for the foreseeable future. Policymakers are also awaiting more clarity on U.S. President Donald Trump’s policies, particularly tariffs, which have already led to rising consumer inflation expectations. The report came a day after Fed Chairman Jerome Powell said the central bank could take a break when it comes to interest rates. Traders are now shifting their expectations for the next Fed rate cut to December from September. Interest rate futures traders are currently pricing in just 26 basis points of rate cuts by the Fed through December, down from about 37 basis points before the data was released, meaning the Fed will make just one 25 basis point cut this year.

Nick Timiraos, a “Fed mouthpiece” and Wall Street Journal reporter, pointed out that the strong inflation data in January made the Fed’s case for further “recalibration” of the interest rate cut path before the middle of the year untenable. Earlier, Trump also called on the Fed to lower interest rates on social media, which would “go hand in hand” with the upcoming tariff policy. Given the “off-the-charts” CPI data, it is foreseeable that the relationship between the Fed and the White House is about to enter a “tense period”. And Powell has made it clear that they will stick to their dual mission and they will not be bullied by any politician.

In summary, the unexpected performance of the US inflation data in January, especially the continued rise in housing costs, has become the main factor pushing up overall inflation. This situation not only puts pressure on home buyers, but also makes the Federal Reserve more cautious in formulating monetary policy. Although the Federal Reserve has begun to cut interest rates, the inflation level has not yet reached its ideal target, which limits the room for further interest rate cuts. In the future, the Federal Reserve will closely monitor changes in inflation data, while considering the uncertainty of the Trump administration’s policies to decide whether it is necessary to adjust interest rate policies. Market participants also need to pay attention to these dynamics to cope with possible economic and financial risks.