U.S. non-farm payroll data in December exceeded expectations, financial markets are in turmoil again

- January 14, 2025

- Posted by: Macro Global Markets

- Category: News

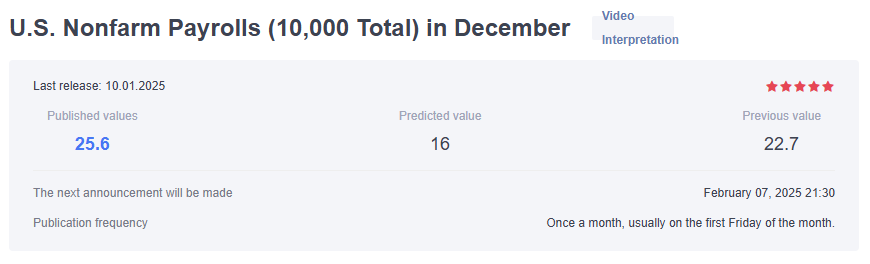

December seasonally adjusted non-agricultural data

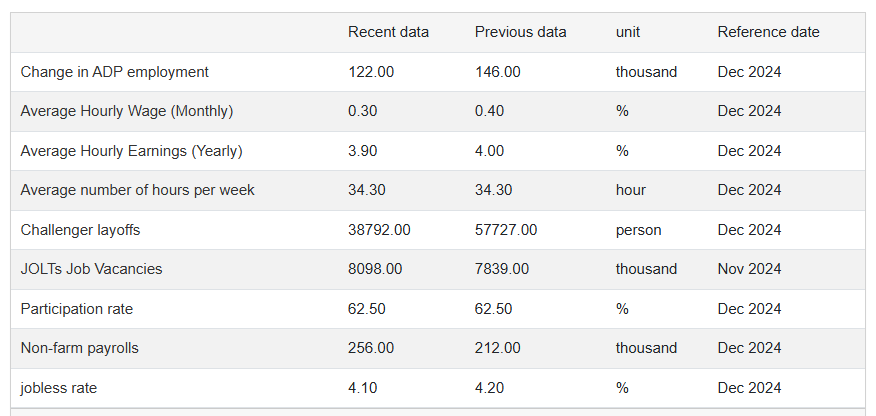

In December 2024, the U.S. economy added 256,000 new jobs, which was higher than market expectations of 160,000 and a new high since April 2024 . The previous data for November was lowered to 212,000, and the data for October was also adjusted, resulting in a total reduction of 8,000 positions in October and November. In December, job growth was mainly concentrated in the fields of health care (46,000), government (33,000) and social assistance (23,000).

In addition, retail trade added 43,000 jobs in December after losing 29,000 jobs in November. The main increases were in clothing, clothing accessories, footwear and jewelry retailers (23,000), general merchandise retailers (13,000), and health and personal products. Care retailers 7,000. At the same time, manufacturing employment fell by 13,000. Throughout 2024, wage employment will grow by 2.2 million, with an average monthly increase of 186,000, down from 3 million in 2023, which increased by an average of 251,000 monthly. Still, the data point to a strong and stable labor market.

Non-farm payroll data exceeds expectations: The U.S. job market is good, which is bullish for the US dollar and bearish for gold.

Non-agricultural market changes

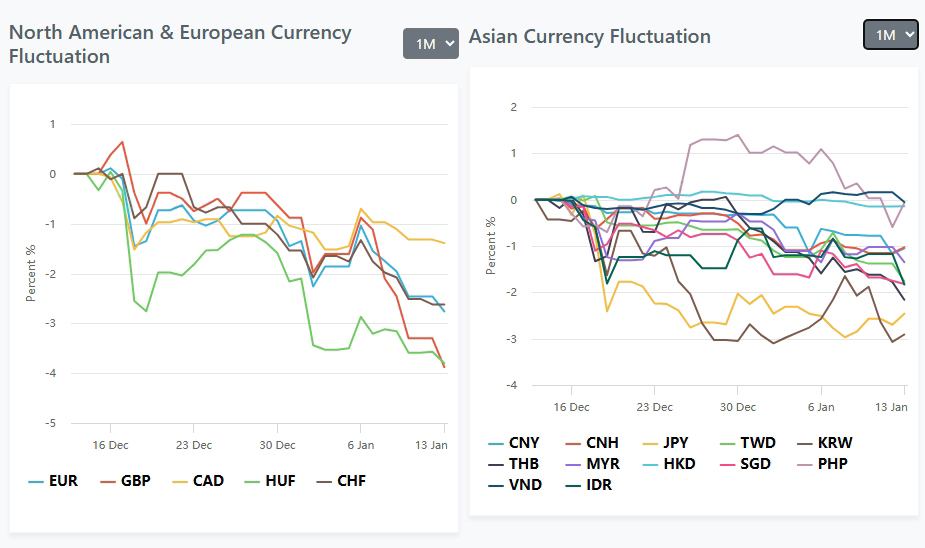

Forex market

The U.S. dollar index: rose this week, closing at 109.64, rising for six consecutive weeks. It first fell and then rose on Monday due to rumors about Trump’s tariff policy. Since then, it has continued to strengthen due to expectations of tariffs and a slowdown in interest rate cuts by the Federal Reserve. Friday’s non-agricultural data exceeded expectations, causing a short-term surge.

Sterling: Slumped sharply to its lowest level since November 2023. Options trading volume surged on Wednesday, with hedge funds buying a large number of put options, and the cost of hedging against the pound’s fall soared in the coming week.

Japanese Yen: The U.S. dollar briefly rose to its highest level against the Japanese yen since July 2024, with comments from the Bank of Japan governor keeping the yen relatively weak.

Asian Currencies: The Asian currency index fell to a 20-year low as the U.S. dollar gained across the board.

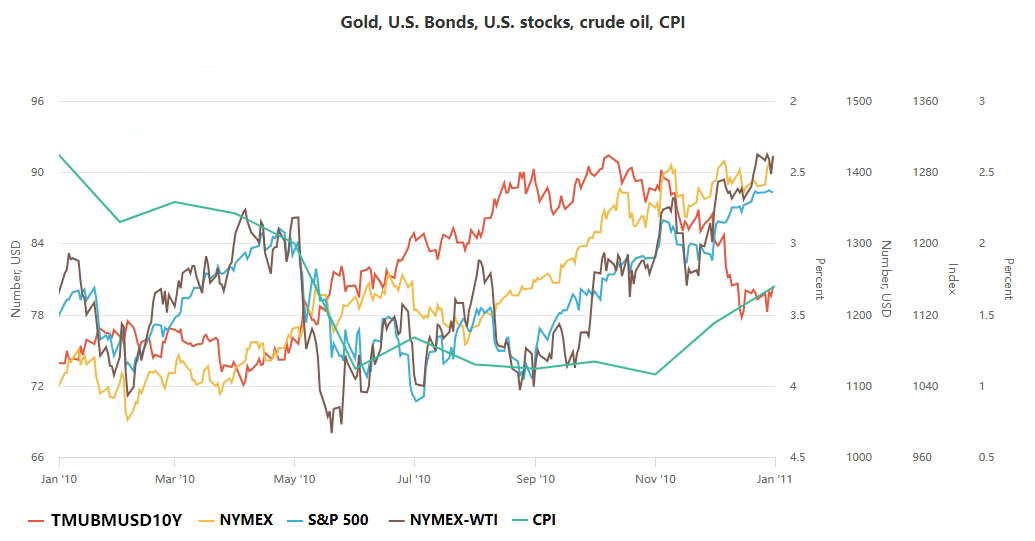

gold market

Spot gold rose for four consecutive days this week to a four-week high, with a cumulative increase of 1.9%. It fell sharply in the short term after Friday’s non-agricultural data. However, news of the Houthi armed attack on a US aircraft carrier quickly recovered its losses and turned higher, closing at about $2,690 per ounce. .

oil market

International oil prices ended the week overall higher and rose sharply on Friday as the cold winter led to strong oil demand and the escalation of Western sanctions may lead to tight crude oil supply from Russia and Iran.

stock market

The Nasdaq fell 2.34% this week, the S&P 500 fell 1.94%, and the Dow fell 1.86%, all falling for two weeks in a row.

Bitcoin

The market was in a huge shock this week. It briefly returned to the US$100,000 mark at the beginning of the week and then fell for three consecutive days. On Friday night, more than 120,000 people liquidated their positions in 24 hours, with a total liquidation amount of US$336 million.

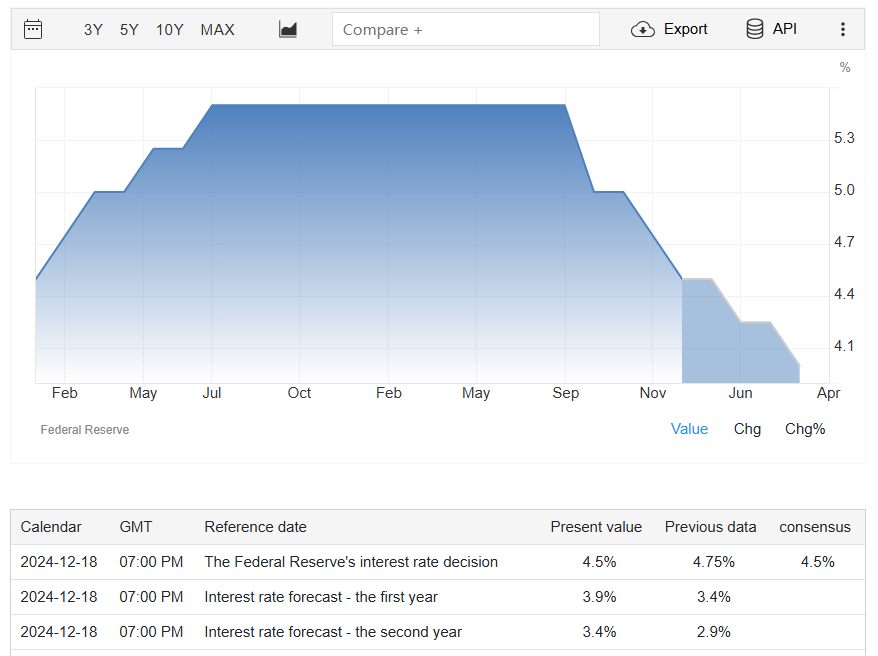

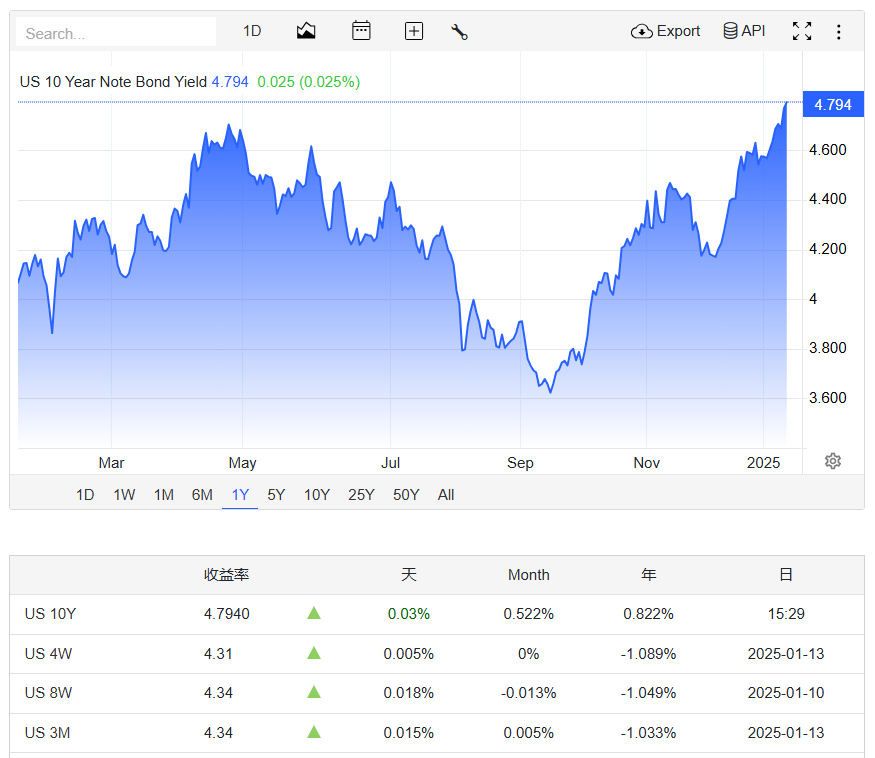

The impact of strong non-farm payrolls on U.S. debt and interest rate cut expectations

Strong U.S. labor market data led traders to postpone expectations for the next Federal Reserve interest rate cut until the second half of the year, sending U.S. Treasuries tumbling. The surge in employment in December pushed U.S. bond yields up across the board, with the 30-year yield breaking 5% and the 10-year yield reaching the highest level since 2023. Swaps traders expect the Fed to cut interest rates by only about 28 basis points this year, with a 25 basis point cut possible in September.

Professionals believe that strong employment data caused the market to reprice the Fed’s short-term expectations, leading to a bearish flattening of the yield curve. BlackRock portfolio managers said financial conditions undermined the Fed’s policy tightening view. The head of global macro at Fidelity Investments is worried that the inflation “dragon” has not been eliminated, which may prevent the Federal Reserve from further cutting interest rates, but the market has not considered this situation.

Rising U.S. bond yields had calmed U.S. stocks on expectations of economic growth and an interest rate cut by the Federal Reserve. Today, the 10-year U.S. Treasury yield is approaching 5%, causing investors to worry. Wall Street is debating whether a 10-year U.S. Treasury yield of 5% is negative for U.S. stocks, but most strategists still expect U.S. stocks to rise this year. The chief investment strategist of State Street Global Advisors believes that the direction of U.S. stocks depends on earnings rather than Fed policy, and earnings growth is the focus.

authoritative opinion

Citi :

Citigroup, the most optimistic among major Wall Street banks for interest rate cuts, still expects five rate cuts of 25 basis points, but they will begin in May instead of January as previously expected. Goldman Sachs said that based on the latest data, the Federal Reserve is expected to cut interest rates by 25 basis points each in June and December 2025 (previously expected to cut interest rates three times), and then cut interest rates once more in June 2026, maintaining the terminal interest rate at 3.5%-3.75%.

CME Group :

CME Group’s “Fed Watch” tool shows that the market expects the probability of only one interest rate cut this year to rise to more than 60%. Regarding the more critical question of “when will the interest rate be cut for the first time this year?”, CME data also shows that against the backdrop of an interest rate cut being unlikely in January, the probability of no interest rate cut in March has now risen from 56% before the data was released. 70%.

Goldman Sachs, said that U.S. stocks are at historically high levels in terms of both absolute and relative valuations. “However, based on the current macro environment and company fundamentals, our model suggests that the S&P 500 is trading broadly at fair value. In my market experience, excessive focus on valuation can hurt investors more than help . There is a difference between a ‘fully valued’ market and a ‘highly valued’ market, and our model believes that the current U.S. stock market belongs to the former, not the latter.”

BofA Securities :

at Bank of America Securities , warned that the basic prediction is that the Federal Reserve will keep interest rates unchanged, but the risk of the next move is already tilted towards raising interest rates. She continued to point out that the threshold for the Fed to raise interest rates is very high, and officials tend to be restrained in changing the current interest rate level. However, if the inflation indicator PCE (Personal Consumption Expenditures Price Index) that the Fed cares about accelerates again, then the possibility of raising interest rates will increase. will be put on the table.

The increase in nonfarm payroll employment in December was mainly driven by the health care and social assistance, retail trade, leisure and hospitality industries. Government employment also rose. Manufacturing and wholesale trade both declined. Friday’s report confirmed that the U.S. job market performed well last year despite high borrowing costs, lingering inflation and political uncertainty. While demand for workers has slowed and unemployment rose in 2024, the economy still added 2.2 million jobs, down from 3 million in 2023 but up from 2 million in 2019.